PRC ramps up drone component shipments to Russia as fiber-optic FPVs reshape battlefield

Battery and fiber-optic exports to Russia surge

There is strong evidence that China is supplying batteries and fiber optic cables used by Russian drone forces. As Russia’s summer offensive begins, it has launched its largest drone-and-missile strikes of the war, hitting 80 residential buildings and injuring at least 70 people.

Battery-powered first-person view (FPV) drones are central to this offensive. Both sides are deploying millions of drones, but Russia is increasingly and effectively employing fiber-optic FPV drones, according to The Washington Post. Unlike larger fixed-wing drones like the Shahed-136, FPVs run on Lithium-ion (Li-ion) batteries. While slower and less capable, FPVs are cheap and expendable. Fiber-optic cables, which can stretch for kilometers, shield them from electronic warfare interference. As has been the case throughout the conflict, Chinese dual-use industrial technologies have provided critical support for Moscow’s illegal invasion of Ukraine.

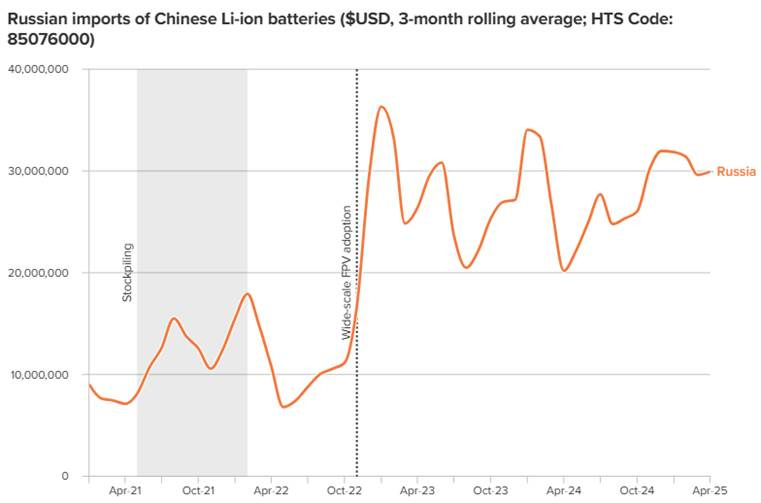

PRC battery exports to Russia have risen significantly – and are almost certainly used for drones

PRC exports of Li-ion batteries to Russia have risen sharply since the full-scale invasion. Li-ion trade statistics are hard to compare over time, due to substantial technological improvements (especially greater energy density) and rapid cost reductions over the past three years. Still, Chinese shipments to Russia exhibited the same basic pattern as other dual-use goods such as excavators, trucks, and more. After shipments fell in the initial phase of the war, China provided critical exports in the fall of 2022, after Russian forces began to fall back and as the character of the conflict shifted.

Sources: GACC, Author’s Calculations

While Chinese trade statistics do not offer detail beyond the 8-digit level, Li-ion batteries are mainly used for four purposes: electric vehicles, grid storage, aerial drones, and other use cases (such as consumer electronics). Russia’s battery imports are likely largely directed to its drone market, for battlefield use.

In 2024, Russia sold 17,805 EVs. Assuming ~45 kWh per battery and ~$115/MWh for Chinese LFP packs, EV-related battery imports totaled ~$92 million—just 28% of the $327 million in Li-ion imports from China. Given minimal grid storage and consumer electronics capacity, most remaining batteries likely support drone production.

Russia hasn’t installed significant battery grid storage, nor does it have substantial consumer electronic production. In fact, China is Russia’s main supplier of consumer electronics.

Given that Russian EV production is very limited, batteries for grid storage appear negligible, and that Russia doesn’t have a major consumer electronics industry, most Li-ion battery imports are deployed for the drone market – and the war in Ukraine.

Fiber optic component exports

PRC export data shows sharp spikes in fiber optic cables to Russia, likely reflecting their use in drones targeting Ukrainian forces and civilians. Russia’s imports, measured in kilometers, have surged in recent months - and just as its battlefield tactics shifted to incorporate fiber optic-FPVs.

Sources: GACC, Author’s Calculations

Similarly, Russian imports of specialty optical fibers have spiked since the invasion. Extreme per-kilogram price spikes in Jan 2023 and Jan 2025 likely reflect small shipments of specialized or military-grade fiber with high unit value, not bulk telecommunications fiber.

Sources: GACC, Author’s Calculations

The PRC’s battery complex holds massive, latent dual-use capabilities

Russia has gained key military capabilities from Chinese exports of Li-ion batteries and fiber optic cables. Drones—especially FPV types—now account for about 80 percent of frontline combatant casualties, and Russia’s use of fiber-optic FPV drones has given it a critical but hopefully temporary battlefield edge.

China’s support underscores its willingness to back Russia’s defense industrial base. Yet it has mobilized only a fraction of its vast dual-use battery capacity. While geographic and technical limits may constrain battery-powered drones in a Taiwan scenario, coalition planners should prepare for drone warfare on a far larger scale than in Ukraine.

Notably, less than 1% of China’s Li-ion battery exports go to Russia—a tiny share of its total production. Note that the below figures do not account for China’s domestic massive battery market in EVs, storage batteries, and more.

Sources: GACC, Author’s Calculations

Drones and advanced batteries are reshaping the conflict in Ukraine – and beyond

China’s surging exports of Li-ion batteries and fiber-optic components are quietly reshaping the war in Ukraine. These dual-use technologies have enabled a wave of cheap, attritable, and increasingly sophisticated drone warfare. Though Russia receives only a small share of China’s battery output, even that fraction is proving consequential. Future conflicts—especially in the Indo-Pacific—could see drone warfare on a vastly larger scale. Coalition planners must prepare accordingly.

Until next time,

Joe

Joe Webster is a senior fellow at the Atlantic Council and editor of the China-Russia Report. This article represents his own personal opinion.

The China-Russia Report is an independent, nonpartisan newsletter covering political, economic, and security affairs within and between China and Russia. All articles, comments, op-eds, etc represent only the personal opinion of the author(s) and do not necessarily represent the position(s) of The China-Russia Report.