Beijing’s role in fortifying Russia’s front lines

Chinese vehicle exports facilitated Russia’s construction of trenches in occupied Ukraine

There is extremely compelling evidence that Chinese excavator and front end shovel loaders exports facilitated the construction of Russian trenches and other fortifications ahead of Ukraine’s counteroffensive, as I discussed in an analysis for the WSJ.

This post includes additional commentary and more expansive data of Chinese vehicle exports. Chinese year-to-date (YTD) exports to Russia of compression-ignition internal combustion piston engine (diesel or semi-diesel) are up 4,708 percent from prior year levels. While there has been an understandable focus on China’s exports to Russia of semiconductors and dual-use equipment, such as drones or night vision goggles, the PRC’s vehicle exports to Russia have played a major, potentially decisive, role in enabling Moscow’s invasion of Ukraine.

PRC excavator exports enabled Russian forces to entrench positions

PRC vehicles enabled Russia to construct defensive fortifications during what may have been the most critical part of the war: August and September of 2022. During late summer and early fall, Ukrainian enjoyed successes in rolling back the Russian invasion; Russian forces were famously routed around Kharkiv. After a series of defeats, Russian forces began to regroup behind the so-called “Surovikin Line” of defensive fortifications of trenches and other features.

Just as Russian forces began to dig trenches, Chinese exports to Russia of trench-digging equipment, such as excavators, which are used to dig dirt out of the ground, and front end shovel loaders, which move dirt around on the surface, suddenly accelerated in August 2022 and, especially, September 2022. Chinese excavator exports to Russia more than tripled in September 2022, when compared to prior-year levels.

Source: PRC General Administration of Customs, Author’s Calculations

Similarly, Chinese exports of front end shovel loaders in September 2022 more then doubled from September 2021.

Source: PRC General Administration of Customs, Author’s Calculations

At a minimum, Chinese exports of these vehicles enabled Russia to repurpose its existing inventory of excavators and front end shovel loaders and move them to the front lines. Indeed, the WSJ found evidence that some Chinese-produced excavators went directly to Ukraine.

PRC exports of trench-digging vehicles to Russia almost certainly had an immediate and material impact on the invasion of Ukraine. Chinese equipment exports enabled Russia to continue building domestic infrastructure, repair roads, etc, at a minimum. Chinese-made trench-digging equipment provided Russian forces with a critical battlefield enabler and very likely enabled Russia to inflict hundreds, if not thousands, of casualties on Ukrainian forces.

Chinese truck exports to Russia: indirect, but vital

Chinese truck exports to Russia are also providing indirect support for the Kremlin’s invasion of Ukraine. As Janis Kluge and I noted, Chinese exports may enable Russian heavy duty truck manufacturer KAMAZ to repurpose civilian production lines and build armored vehicles for Russia’s military. Just as importantly, they help mitigate transportation bottlenecks, ensuring that the Russian economy – and the war effort – receive material goods.

Chinese heavy duty truck exports to Russia remain very elevated (as first explored in March). Russian YTD imports of very large trucks weighing more than 20 tons have risen nearly 1114% from comparable 2021 levels, in value terms. While Chinese auto exports have broadly surged in the past year, its exports of heavy duty trucks have been overwhelmingly shipped to Russia and other countries in Moscow’s orbit. Indeed, China’s YTD exports of heavy duty trucks to countries outside of Russia and the “near abroad” are down from 2022 levels in absolute terms and are nearly flat from 2021, without adjusting for inflation or exchange rates.

Source: PRC General Administration of Customs, Author’s Calculations

Chinese very large truck exports have more than doubled since 2021, in value terms, but Russia and “near abroad” countries in Central Asia, the Caucuses, and Belarus have absorbed the entirety of the increase.

In volume terms, China has shipped more than 32,000 heavy duty trucks to Russia in the first seven months of the year, compared to just 2,800 in 2021.

Source: PRC General Administration of Customs, Author’s Calculations

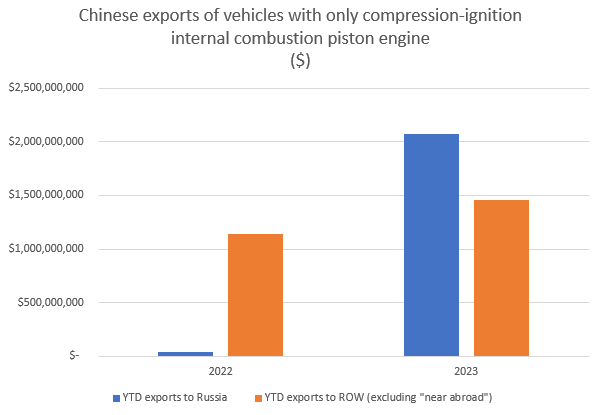

Finally, Chinese year-to-date exports to Russia of vehicles with compression-ignition internal combustion piston engine (diesel or semi-diesel) have positively exploded over the past year: they are up 4708 percent (not a typo) from 2022 levels, in volume terms, according to official Chinese GACC trade data.

Source: PRC General Administration of Customs, Author’s Calculations

As was seen with heavy duty trucks, Russia accounts for the overwhelmingly majority of the increase in the value of Chinese exports of diesel or semi-diesel vehicles. In the first seven months of 2022, Russia accounted for only 3 percent of China’s diesel or semi-diesel vehicle exports, as measured by value. By 2023, its share had risen to 58 percent.

Source: PRC General Administration of Customs, Author’s Calculations

China’s diesel and semi-diesel exports to Russia are of uncertain strategic potential. It’s possible that Russian soldiers are directly using these vehicles on the front lines or, perhaps more likely, employing them indirectly by shifting other autos to the front line. In any event, China’s diesel and semi-diesel exports are undeniably restraining Russia’s domestic inflation.

The PRC’s “non-lethal” trade with Russia has had lethal consequences

The final chapter in the invasion of Ukraine is far from written. Still, it’s clear that Chinese vehicle exports played an important role a pivotal moment, enabling Russian forces to construct trenches and slow down the Ukrainian counterattack at a time of grave danger for the invasion.

Joe Webster is a senior fellow at the Atlantic Council and editor of the China-Russia Report. This article represents his own personal opinion.

The China-Russia Report is an independent, nonpartisan newsletter covering political, economic, and security affairs within and between China and Russia. All articles, comments, op-eds, etc represent only the personal opinion of the author(s) and do not necessarily represent the position(s) of The China-Russia Report.