How Beijing manifests economic support for Moscow: super-heavy trucks and (potentially) the Minsk cutout

Trade data suggests China could be using Belarus as a cutout to extend economic and potentially even military support to Russia. Meanwhile, China-Russia direct trade continues to grow rapidly.

Belarusian strongman Alexander Lukashenko’s March 1st state visit to Beijing not only reflects growing political ties between Belarus and China. Perhaps more importantly, Lukashenko’s visit suggests Minsk is an increasingly useful “middleman” for Moscow and Beijing as both capitals seek to find seams in sanctions and ensure that the Kremlin has the resources necessary to prevail in Ukraine.

Belarus-China trade grew nearly 60 percent in the second half of 2022

Belarus dramatically expanded trade ties with China in the latter months of 2022. According to (not always reliable) official Chinese trade data, Chinese exports to Belarus rose 49 percent to over $2.1 billion USD in the second half of 2022, when compared to the same period in the prior year. Meanwhile, Chinese imports from Belarus surged 86 percent to just under $1.0 billion USD, also when compared to the same period in the prior year.

Sources: PRC General Administration of Customs, Author’s Calculations

Bilateral trade could expand even further this year. The Belarusian Ambassador to China, Yuri Senko, claimed to Belarusian state media that January 2023 “posted a 200% increase in the exports of Belarusian goods [to China].” If Senko is correct in asserting that Belarusian exports to China in January 2023 grew 200 percent from the same period prior-year levels, Belarusian monthly exports to China would have hit a record $343 million.

There is no apparent economic reason for Belarusian exports to China to rise by that amount. Minsk’s exports to Beijing have traditionally consisted of meat, dairy, and wood products, but world food prices have fallen for 11 straight months, according to the United Nations. Geopolitics and shifting trade flows due to sanctions – not fundamental economic support – are animating Belarusian exports to China. Indeed, China’s sudden surge in bilateral trade with Belarus suggests Beijing may be indirectly financing Lukashenko’s’ formation of a new 100,000 – 150,000 strong “volunteer force” or using Minsk as a cutout to provide economic and potentially even military assistance for Moscow.

Chinese indirect and direct exports to Russia: semiconductors and heavy-duty trucks

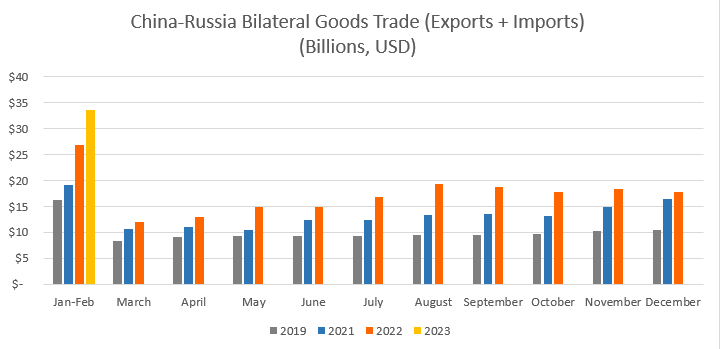

China is not only expanding trade ties with Belarus. It’s also potentially importing record volumes of Russian crude oil and extending critical export assistance. Chinese semiconductors have found their way to Russia via Turkey and other countries, according to the Wall Street Journal, while overall bilateral trade has risen sharply from pre-pandemic levels and shows no signs of slowing. In the January – February period (grouped together due to the Lunar New Year holiday), bilateral trade reached nearly $34 billion, more than twice 2019 levels in the same period.

Sources: PRC General Administration of Customs, Author’s Calculations

Vehicle trade plays an increasingly important, if potentially underappreciated, role in China’s economic relationship with Russia. China’s market share in Russia’s passenger vehicle market more than tripled in 2022 to 31.3 percent. Especially notable is China’s export of super-heavy trucks to Russia, which more than quadrupled last year.

Sources: PRC General Administration of Customs, Author’s Calculations

China’s exports of super-heavy trucks may have been immensely helpful to Russia’s war efforts. Just as trucking-related shortfalls were a major cause of US inflation in 2021, Chinese supplies of super-heavy trucks may have prevented shortages in critical regions of Russia, limiting price increases and helping to preserve popular support for Moscow’s invasion of Ukraine. Moreover, Chinese exports of super-heavy trucks may have indirectly or even directly supported Russian front-line military forces. The military analysis site Oryx has documented Russian truck, vehicles, and jeeps losses of at least 2,330 – with the real number likely significantly higher. While commercial and military-grade trucks are vastly different, Russia may be dual-purposing civilian trucks. For instance, after an explosion damaged the Crimean bridge in October, more than 250 trucks piled up on both sides of the waterway, with satellite imagery showing a massive backlog.

It’s difficult to assess the impact of Chinese trucks on the war, but there are growing signs that super-heavy trucks have significantly aided Russia’s war effort. After initially declining to sanction the item in September, the U.S. Department of Commerce added super-heavy trucks to its Russian and Belarusian industry sector sanction list in late February.

China’s economic ties with Russia, Belarus set to increase further

The PRC’s trade with Russia and Belarus will likely rise even further in 2023 due to Beijing’s geopolitical choices; the likelihood of persistently high oil prices; and the Chinese economy’s return from zero-COVID. A key uncertainty is whether Beijing will begin to supply military kit to Russia and Belarus, or use its economic and diplomatic leverage to encourage Minsk to enter the conflict. Given Beijing’s increasingly open alignment with Moscow, as well as its growing tensions with the West over semiconductors, Taiwan, and more, there is little reason for optimism.

Joseph Webster is a senior fellow at the Atlantic Council and editor of the China-Russia Report. This article represents his own personal opinion.