Central Asia and Belarus’ role in militarily-sensitive trade

Tiers 2 (Additional electronics items), 3.B (mechanical components), and 4.B (CNC machines).

This is the second article in a series on China-to-Russia trade of military-significant "Common High Priority List" (CHPL) items. The first article focused on direct trade; this one examines indirect trade via Central Asia and Belarus.

Russia is increasingly prioritizing Tier 4.A goods (equipment for manufacturing, testing, and producing electric components), with most of the $120 million in Chinese Tier 4.A exports to Russia, Belarus, and Central Asia over the past three months going directly to Russia ($112 million). However, rising Chinese Tier 4.A exports to Central Asia and Belarus suggest Russia may be building alternative trade routes. Imports to Central Asia and Belarus remain elevated, almost certainly supporting indirect China-to-Russia trade of sensitive items.

CHPL categories:

The U.S., EU, UK, and Japan have compiled the “Common High Priority List,” or CHPL, of 50 items that are most relevant for Russia’s war effort. The CHPL of militarily-sensitive items is divided into four tiers, per the U.S. Department of Commerce:

· Tier 1: Items of the highest concern due to their critical role in the production of advanced Russian precision-guided weapons systems, Russia’s lack of domestic production, and limited global manufacturers.

· Tier 2: Additional electronics items for which Russia may have some domestic production capability but a preference to source from the United States and its partners and allies.

· Tier 3.A: Further electronic components used in Russian weapons systems, with a broader range of suppliers.

· Tier 3.B: Mechanical and other components utilized in Russian weapons systems.

· Tier 4.A: Manufacturing, production and quality testing equipment for electric components, circuit boards and modules.

· Tier 4.B: Computer Numerically Controlled (CNC) machine tools and components.

Central Asia and Belarus: CHPL relative imports

Chinese exports to Central Asia and Belarus have surged since the beginning of the invasion and remain highly elevated. Note that the sharp initial decline in exports this year is almost certainly attributable to Lunar New Year: Chinese monthly global exports dropped from $307 billion in January 2024 to just $220 billion the next month.

Source: PRC GACC, Author’s Calculations

Chinese CHPL exports to Central Asia and Belarus have stabilized in absolute terms but are driven by Tier 3.B, which includes items such as ball bearings and other mechanical components.

Source: PRC GACC, Author’s Calculations

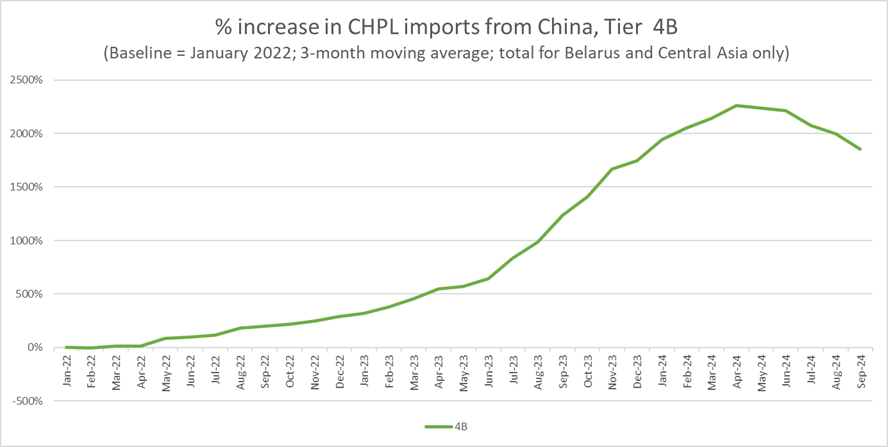

Central Asia + Belarus’ imports of Tier 4.B items (Computer Numerically Controlled (CNC) machine tools and components) is astonishing, in proportional terms: shipments have increased 20-fold since the beginning of the conflict. The vast majority of these imports are, of course, presumably transshipped to Russia.

Source: PRC GACC, Author’s Calculations

Of the ~$32 million USD of Chinese Tier 4.B exports shipped to Russia, Belarus, and Central Asia, on average, over the past three months, about $9 million of these shipments was sent via the “indirect route” of Central Asia and Belarus.

Turning to other Tiers, we observe that Chinese exports to Central Asia and Belarus remain well above pre-war levels.

Crucially, Chinese exports of Tier 1 semiconductor components to Central Asia + Belarus rose sharply in the post-invasion period and remain elevated. Additionally, imports of some sub-tier categories (such as ball bearings, for instance) have risen sharply. Finally, note that – just as with Russia – exports of Tier 4.A goods (electric components, circuit boards and modules) have risen sharply in recent months.

Source: PRC GACC, Author’s Calculations

Finally, Belarus + Central Asia have grown in importance for meeting bloc-wide imports of CHPL goods since the beginning of the conflict. In the chart below, for instance, you can see that while Belarus and Central Asia accounted for 10% of China’s total Tier 2 exports to the Russia-Central Asia-Belarus bloc in January 2022, that figure has risen to 33% in September 2024, the latest period for which data is available.

Russia appears to be sourcing a substantial fraction of CHPL goods from Central Asia and Belarus, especially for the following Tiers: 2 (Additional electronics items), 3.B (mechanical components), and 4.B (CNC machines).

Source: PRC GACC, Author’s Calculations

China and Russia continue to directly conduct most of their trade in militarily-sensitive goods. Still, Central Asia and Belarus continues to serve as a cutout for substantial indirect China-to-Russia trade, including for sensitive items.

Until next time,

Joe Webster is a senior fellow at the Atlantic Council and editor of the China-Russia Report. This article represents his own personal opinion.

The China-Russia Report is an independent, nonpartisan newsletter covering political, economic, and security affairs within and between China and Russia. All articles, comments, op-eds, etc represent only the personal opinion of the author(s) and do not necessarily represent the position(s) of The China-Russia Report.