China's militarily-sensitive exports to Russia are evolving

Surging bilateral trade is due to electric components, not just autos

Chinese direct exports to Russia are rising – and shifting. Past changes in PRC exports of military-relevant goods have aligned with key developments in the war, such as trench-digging equipment exports coinciding with Russia's construction of the Surovikin Line. Recent data indicates that China is dramatically increasing shipments of electric components, circuit boards, and modules to Russia, potentially signaling shifts in Russia’s defense industrial posture, battlefield tactics, or both. With China supplying the bulk of Russia’s direct and indirect imports, trade data may offer valuable insights into Russia’s defense industry priorities and the evolving nature of the conflict.

Chinese exports to Russia of High-Priority Goods are rising again

Beijing has been openly but not explicitly supplying Moscow with critical defense industrial base support throughout its invasion of Ukraine. Parenthetically, you can read a short history of post-February 2022 bilateral trade here, or a prior explainer about Beijing’s role in fortifying the Russian front lines.

Chinese direct exports to Russia reached $11.25 billion September 2024, an all-time high. Rising Chinese exports were partially attributable to an anticipated increase in Russian import duties of Chinese autos, as SWP’s Janis Kluge noted.

Source: PRC GACC, Author’s Calculations

But the uptick in Chinese exports to Russia is not only due to a one-off event. After a brief retreat this summer in the face of stronger U.S. and allied sanctions, Chinese firms are once again directly engaging with Russian counterparts in militarily-sensitive trade, according to PRC trade data.

The U.S., EU, UK, and Japan have imposed export controls and other measures against militarily-sensitive items. The “Common High Priority List,” or CHPL, consists of 50 items that are most relevant for Russia’s war effort. The CHPL is divided into four tiers, per the U.S. Department of Commerce:

· Tier 1: Items of the highest concern due to their critical role in the production of advanced Russian precision-guided weapons systems, Russia’s lack of domestic production, and limited global manufacturers.

· Tier 2: Additional electronics items for which Russia may have some domestic production capability but a preference to source from the United States and its partners and allies.

· Tier 3.A: Further electronic components used in Russian weapons systems, with a broader range of suppliers.

· Tier 3.B: Mechanical and other components utilized in Russian weapons systems.

· Tier 4.A: Manufacturing, production and quality testing equipment for electric components, circuit boards and modules.

· Tier 4.B: Computer Numerically Controlled (CNC) machine tools and components.

According to official PRC data, Chinese exports to Russia of CHPL goods have risen in recent months. (Note that the following analysis tracks only Chinese exports’ value, not quantities. Values are a function of price and quantity).

Source: PRC GACC, Author’s Calculations

China-Russia direct trade in CHPL goods has shifted dramatically in recent months. Why?

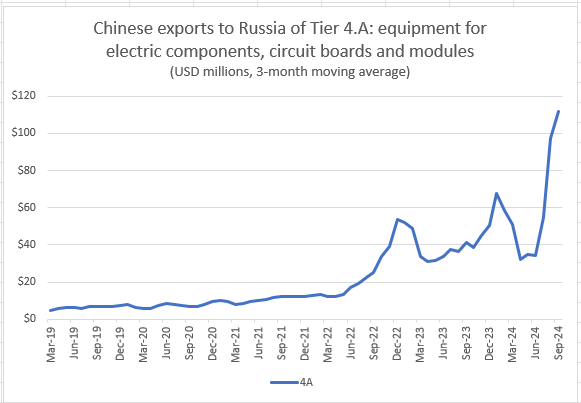

While overall CHPL trade has rebounded, Beijing and Moscow’s increasingly direct trade in these items is shifting in important ways. For whatever reason, Chinese exports to Russia of Tier 4.A goods (Manufacturing, production and quality testing equipment for electric components, circuit boards and modules) have risen dramatically since the summer.

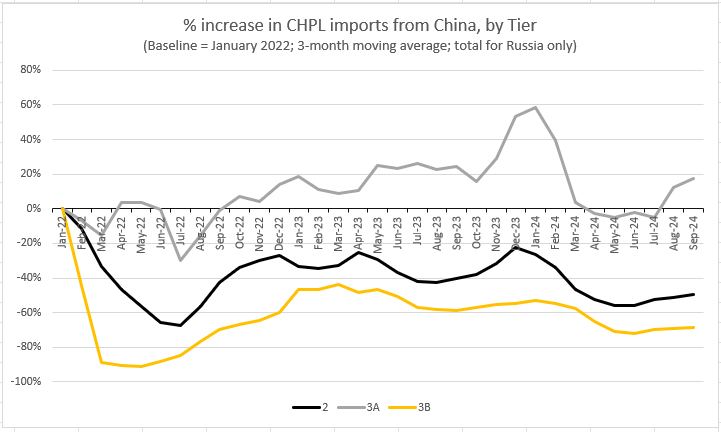

In the charts below, I’ve calculated the relative change in CHPL imports: negative numbers indicate a percentage decrease from January 2022 levels (at the 3-month moving average), while positive figures show the percentage rise. This methodology isn’t perfect. For starters, it’s not clear what the suitable base period “should” be, due to COVID and pre-war stockpiling by Russia. Still, comparing current import levels to the immediate pre-war period establishes a reasonable baseline and allows for better visualization and contextualization of militarily-sensitive trade on a tier-by-tier basis.

Source: PRC GACC, Author’s Calculations

China’s direct exports to Russia of Tier 1, 4A, and 4B CHPL goods rose significantly in the early days of the war, then surged.

Tier 1 CHPL goods – the highest priority goods and bolded in red in the chart above – have recently fallen below pre-war levels. Still, this trend may only be temporary; Russia’s wartime needs may have shifted so that it requires fewer Tier 1 goods; it’s possible that the PRC may be disguising Tier 1 shipments; and, ultimately, this analysis measures value – not volumes. It’s far too soon to conclude that Western efforts to restrict Tier 1 China-to-Russia shipments have worked in recent months or not.

Tier 4B imports (CNC tools and components), meanwhile, have continued their relative decline but remain at about three times pre-war levels.

Strikingly, China’s direct exports of Tier 4A goods (electric components, circuit boards and modules) began surging in July 2024. More on that in a minute.

You may have noticed several CHPL Tier categories were missing on the above chart. That’s because I purposely split the data into two charts due to scale. Direct China-to-Russia exports of Tier 1, Tier 4A and (especially) Tier 4B goods saw a massive surge. Meanwhile, China-to-Russia exports of goods in Tiers 2, 3A, and 3B have fallen or remained relatively flat in value terms. For instance, Tiers 2 and 3B direct shipments remain well below pre-war levels. Direct exports to Russia for Tier 3A, the largest export category in value terms, are comparable to pre-war levels, in percentage terms.

Source: PRC GACC, Author’s Calculations

Electric components, circuit boards and modules

Let’s come back to Tier 4.A: (Manufacturing, production and quality testing equipment for electric components, circuit boards and modules). The chart below isolates Tier 4.A in value terms. Note that shipments picked up after the invasion, then lifted off as the PRC’s semi-overt support for the invasion firmed up around June 2022. After surging in July, Chinese exports of Tier 4.A products now stand at an all-time high, as measured by three-month moving averages.

Source: PRC GACC, Author’s Calculations

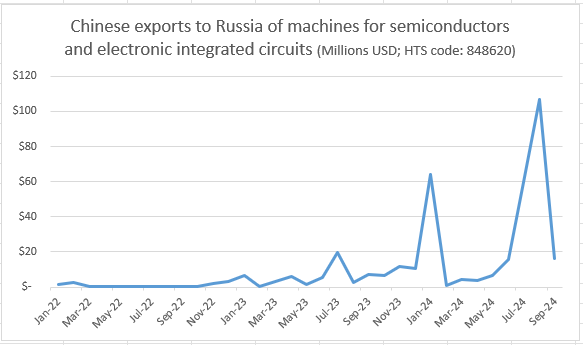

Much of the rise in Tier 4.A goods is recently months has been due to a single line item. YTD exports of Machines and apparatus for the manufacture of semiconductor devices or of electronic integrated circuits (HTS code: 848620) stood at $278 million from January – September 2024, accounting for 47 percent of the total $591 million in Chinese exports of Tier 4.A shipments to Russia in the same period. In the chart below, you can see that Chinese exports to Russia of HTS code: 848620 spiked in three separate months in 2024: January, July, and August.

Source: PRC GACC, Author’s Calculations

The reason behind the sudden pulses in exports of HTS code: 848620 is unclear. Coincidentally - or perhaps not - those same three months aligned with peak Russian missile launches at Ukraine, per data from CSIS’ Assessing Russian Firepower Strikes in Ukraine compiled from Petro Ivaniuk.

Another 4.A category has also seen a sharp rise in recent months: HTS Code: 847180, or “Units for automatic data-processing machines excluding processing units, input or output units and storage units.” While month-to-month trade data can be highly volatile, I’m including it to illustrate, again, that Beijing’s approach to supplying Moscow may have changed in July, for whatever reason.

Source: PRC GACC, Author’s Calculations

It’s striking that U.S. Deputy Secretary of State Kurt Campbell called out Beijing for providing “very substantial" help to Moscow’s war machine in early September. While trade data suffers from lags, it can demonstrate qualitative and quantitative shifts in direct China-to-Russia CHPL trade.

Next Questions

Russian imports of Chinese-made electric components, circuit boards and modules are surging, even as shipments from other “Tiers” on the CHPL remain flat or only edge higher. What do these developments mean, what does that tell us about the Russian war economy, and how can Western policymakers do to constrain Russia arms production? I’m looking forward to seeing some of you next week in person to discuss these topics. As always, feel free to reach out directly to me here or via the AC.

Other CRR housekeeping: I’ll publish a piece on PRC CHPL indirect exports to Russia via Central Asia + Belarus early next week, followed by an article on iron ore’s role in a Taiwan contingency.

Until next time,

Joe

Joe Webster is a senior fellow at the Atlantic Council and editor of the independent China-Russia Report. This article represents his own personal opinion.

The China-Russia Report is an independent, nonpartisan newsletter covering political, economic, and security affairs within and between China and Russia. All articles, comments, op-eds, etc represent only the personal opinion of the author(s) and do not necessarily represent the position(s) of The China-Russia Report.

Dear Joe, thank you for another very helpful report, I think you do amazing work!

If Beijing's approach to supplying Moscow may have changed in July, could it be related to the CCP's 3rd plenary session?

Wang Yi said in a speech to the 75th anniverssary of the establishment of PRC RF relations that the plenum changed their cooperation with Russia:

(from https://www.gov.cn/yaowen/liebiao/202410/content_6978211.htm )

“The historic decision of the Third Plenary Session of the 20th CPC Central Committee to further deepen reforms in an all-round way and promote Chinese-style modernization has brought more opportunities for China and Russia to deepen all-round cooperation. The two sides will take this opportunity to continue to explore their complementary advantages, steadily push forward cooperation in traditional areas such as energy resources, connectivity and agriculture, and create more growth points for cooperation in emerging industries such as information and communications, artificial intelligence and biotechnology, so as to promote high-quality development and modernization of the two sides."

Zhang Hanhui, the PRC ambassador to RF also vaguely said that the 3rd plenum changed their policy:

(from http://news.china.com.cn/2024-10/01/content_117462891.shtml )

"The Third Plenary Session of the Twentieth Central Committee of the Communist Party of China (CPC), which was held in July this year, made systematic arrangements for further deepening reform in a comprehensive manner and advancing modernization in the Chinese style, put forward the need to adhere to the basic State policy of opening up to the outside world and to build a higher level of a new open economic system, and demonstrated a firm determination to cooperate with the world for win-win results and common development, thus injecting stability and positive energy into the world, which is in a state of turmoil and turmoil. We are very pleased to see that all circles in Russia are paying close attention to and discussing the results of the Plenary Session, and sincerely welcome the Russian side to share the dividends of China's comprehensive deepening of reforms, believing that the Plenary Session will surely inject new connotations and bring new opportunities for the development of China-Russia relations."

On the other hand, the plenum was held in the middle of the month, so maybe the policy must have been decided in advance.

Best